Best Investment Books for Beginners

Wiki Article

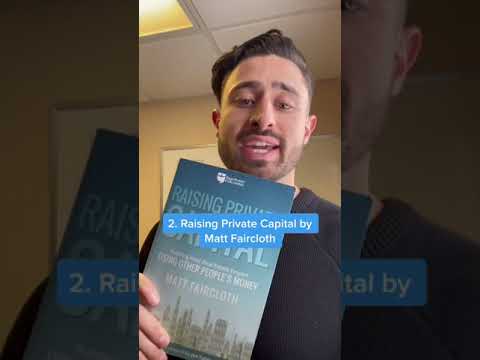

The Best Financial commitment Books

Enthusiastic about turning into an even better Trader? There are numerous guides that can help. Profitable buyers read through extensively to acquire their abilities and remain abreast of rising methods for expense.

The Ultimate Guide To Best Investment Books

Benjamin Graham's The Smart Trader can be an indispensable manual for almost any investor. It covers every little thing from elementary investing tactics and hazard mitigation methods, to price investing tactics and approaches.

Benjamin Graham's The Smart Trader can be an indispensable manual for almost any investor. It covers every little thing from elementary investing tactics and hazard mitigation methods, to price investing tactics and approaches.one. The Minimal Book of Common Sense Investing by Peter Lynch

Written in 1949, this traditional perform advocates the value of investing using a margin of security and preferring undervalued stocks. A necessity-read for anyone thinking about investing, especially These searching further than index cash to establish precise substantial-value prolonged-expression investments. Additionally, it addresses diversification concepts as well as how to avoid remaining mislead by sector fluctuations or other investor traps.

This reserve delivers an in-depth tutorial on how to develop into An effective trader, outlining the many ideas every trader really should know. Subjects talked over while in the ebook range from current market psychology and paper trading tactics, keeping away from common pitfalls for instance overtrading or speculation and much more - building this guide necessary studying for really serious investors who would like to make certain they have an in-depth knowledge of basic investing concepts.

Bogle wrote this thorough e book in 1999 to shed mild to the concealed charges that exist in mutual cash and why most buyers would benefit more from buying reduced-price index resources. His tips of preserving for wet day money even though not inserting your eggs into 1 basket and investing in affordable index cash stays legitimate currently as it absolutely was again then.

Robert Kiyosaki has long championed the significance of diversifying revenue streams by way of real estate property and dividend investments, significantly real estate and dividends. Although Prosperous Dad Very poor Dad might fall much more into private finance than private growth, Prosperous Dad Poor Dad continues to be an instructive read for anyone wishing to better realize compound fascination and how to make their income get the job done for them rather then versus them.

For anything far more contemporary, JL Collins' 2019 reserve can offer some Considerably-necessary perspective. Meant to address the needs of monetary independence/retire early communities (Hearth), it focuses on achieving monetary independence as a result of frugal residing, low price index investing and also the four% rule - and also techniques to lower college student loans, spend money on ESG assets and take advantage of on the net investment decision methods.

2. The Minimal E-book of Inventory Market place Investing by Benjamin Graham

Some Known Facts About Best Investment Books.

Keen on investing but unsure the best way to progress? This book gives sensible assistance published precisely with young investors in mind, from important pupil bank loan credit card debt and aligning investments with own values, to ESG investing and on-line economic assets.

Keen on investing but unsure the best way to progress? This book gives sensible assistance published precisely with young investors in mind, from important pupil bank loan credit card debt and aligning investments with own values, to ESG investing and on-line economic assets.This finest investment decision ebook displays you the way to discover undervalued shares and make a portfolio which will offer a constant source of cash flow. Employing an analogy from grocery searching, this ideal ebook discusses why it is more prudent never to deal with highly-priced, perfectly-promoted products but instead pay attention to reduced-priced, overlooked kinds at income rates. Furthermore, diversification, margin of basic safety, and prioritizing benefit in excess of development are all talked over thoroughly all through.

A classic in its industry, this book explores the basics of value investing and the way to recognize opportunities. Drawing upon his investment business Gotham Cash which averaged an annual return of forty % throughout twenty years. He emphasizes staying away from fads when getting undervalued businesses with potent earnings potential customers and disregarding shorter-phrase current market fluctuations as essential concepts of successful investing.

This ideal financial investment guide's writer supplies tips For brand spanking new buyers to avoid the blunders most novices make and optimize the return on their own cash. With phase-by-action Recommendations on creating a portfolio created to steadily improve eventually and also the writer highlighting why index cash give quite possibly the most efficient implies of expenditure, it teaches audience how to take care of their plan no matter marketplace fluctuations.

Though 1st released in 1923, this reserve continues to be an a must have guideline for any person thinking about handling their finances and investing properly. It chronicles Jesse Livermore's encounters - who attained and dropped hundreds of thousands around his life span - though highlighting the importance of chance idea check here as Component of choice-earning procedures.

When you are trying to get to help your investing techniques, you will discover a lot of great guides to choose from so that you can select. But with limited several hours in on a daily basis and restricted accessible studying material, prioritizing only Those people insights which provide by far the most worth could be hard - Which explains why the Blinkist app supplies this kind of easy accessibility. By gathering vital insights from nonfiction guides into bite-sized explainers.

three. The Minor Book of Price Investing by Robert Kiyosaki

This guide handles investing in enterprises with the financial moat - or competitive edge - such as an economic moat. The creator describes what an economic moat is and offers samples of a number of the most renowned corporations with 1. On top of that, this guide facts how to determine an organization's price and buy stocks In keeping with cost-earnings ratio - perfect for starter investors or anybody attempting to learn the fundamentals of investing.

This doorstop financial investment guide is equally preferred and thorough. It addresses most of the best methods of investing, for example setting up young, diversifying extensively instead of paying large broker costs. Published in an enticing "kick up your butt" style which may either endear it to viewers or transform you off completely; whilst covering several widespread items of recommendation (make investments early when Other individuals are greedy; be wary when Other folks turn into overexuberant), this textual content also suggests an indexing technique which intensely emphasizes bonds in comparison to several equivalent techniques.

This e-book presents an insightful technique for inventory choosing. The author describes how to select profitable shares by classifying them into 6 unique categories - slow growers, stalwarts, rapid growers, cyclical shares, turnarounds and asset plays. By subsequent this straightforward system you boost your odds of beating the industry.

Best Investment Books Can Be Fun For Everyone

Peter Lynch is without doubt one of the earth's Leading fund managers, getting run Fidelity's Magellan Fund for thirteen yrs with a median return that defeat the S&P Index yearly. Printed in 2000, his book highlights Lynch's philosophy for choosing stocks for person investors within an available manner that stands in stark distinction to Wall Road's arrogant and overly complex strategy.

Peter Lynch is without doubt one of the earth's Leading fund managers, getting run Fidelity's Magellan Fund for thirteen yrs with a median return that defeat the S&P Index yearly. Printed in 2000, his book highlights Lynch's philosophy for choosing stocks for person investors within an available manner that stands in stark distinction to Wall Road's arrogant and overly complex strategy.Warren Buffett, among the richest men on the globe, has an uncanny capacity to Feel logically. This book, at first penned as letters to his daughter, has useful and intelligent assistance on generating the stock current market give you the results you want - with its most well-known tip remaining acquiring undervalued assets for in excess of their intrinsic really worth - furnishing newcomers to investing with a fantastic Basis in investing and experienced kinds with useful strategies to make it financially rewarding. This can be one of the best publications to Please read on investing.

four. The Small E book of Stock Industry Investing by Mathew R. Kratter

If you wish to achieve inventory marketplace investing expertise and develop your own portfolio, this e-book delivers a really perfect area to start. It clarifies how to select shares with powerful progress probable while teaching you about analyzing firms - together with helping inexperienced persons steer clear of frequent problems they often make. Also, its obvious and straightforward language make for a nice looking through experience.

Benjamin Graham is called the father of worth investing, an technique centered on getting quality stocks at minimal prices. He wrote two books on investing; Security Evaluation is his signature perform describing his conservative, benefit-oriented approach - it's even been advisable by major read more investors like Bill Ackman and John Griffin!

Peter Lynch has lengthy been regarded as a master within the expense globe as a result of his report-placing accomplishment working Magellan Fund. Lynch averaged 29% returns in the course of his 13 year stint managing it and conquer S&P five hundred index eleven periods from 13. One Up On Wall Avenue facts Peter Lynch's philosophy and approaches that propelled his good results - this e-book needs to be study by any new buyers!